The stock market has an uncanny ability to ignore various factors, until the point that it becomes obsessed with them. Short-term interest rates have been on the rise for the past two years as the Federal Reserve gradually moves the economy away from the ultra-low interest rates brought about during the financial crisis. Even though rising interest rates often have a negative impact on stocks, stocks have managed a pretty strong showing over the past couple of years.

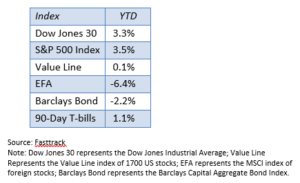

Well, someone on Wall Street finally got the memo and decided to hit the sell button this week, sending the Dow Jones Industrial Average down over 1,000 points in the past two days (over 5%). Performance was even worse for technology stocks, market leaders for the past two years. From the table below you can see that all the major averages for stocks and bonds are congregating around the zero line.

Stocks had been mounting a steady, albeit uneven, recovery since the sharp drop in the first quarter. In fact, most U.S. stock indexes had recently broken out to new highs before this recent sell-off.

The same could not be said about international investments, as well as high quality fixed income investments, as both areas are posting negative returns for the year. The ongoing trade spat is affecting foreign investments, while the Federal Reserve’s moves to increase short-term interest rates are having a negative impact on many types of bonds.

Outlook Through Year-End

During the third quarter, U.S. stocks broke to new highs and reestablished the uptrend in place since early 2016; however, the sharp drop this week has brought stocks right back into the so-called “landing” that we have referenced for much of this year. Our funds are beginning to trip through the FSA Safety Nets® which is why you are beginning to see trade confirmations come through.

There are reasons to be optimistic through year-end as the months of November and December are strong historically. October could continue to be a land mine though, and if market weakness continues into next week, you will see money market allocations continue to rise.

Portfolio Update

Below we show how each strategy is allocated as we head into next week. Keep in mind that because we manage clients’ portfolios individually, the results for your particular accounts may differ somewhat from the averages.

Income (Strategy 1)

It continues to be slow going for any investment that is sensitive to changing interest rates. That includes most types of bond funds. Fortunately, these types of funds have held up very well in this October sell-off. As a result, these portfolios remain fully invested.

Income & Growth (Strategy 2)

Because this strategy typically holds a high proportion of bonds, it has held up rather well in this sell-off. We reduced equities from 50% to 35% this week, while raising money markets to 20% from 5% and holding bonds constant at 45%.

Conservative Growth (Strategy 3)

This strategy entered the week with a full allocation to equities at 75%. In the aftermath of the sell-off, we sold down the equity allocation to 60% – 65%. In addition, we added an Inverse S&P fund that will rise in value if the broad market continues to decline. The money market allocation stands between 10% and 15% with another 20% in bonds.

Core Equity (Strategy 4)

This week we reduced the equity allocation from 95% to 75% – 80%, with another 5% going into an Inverse Nasdaq fund, which is designed to increase in value if the Nasdaq index continues to fall. That leaves the money market position between 15% and 20%.

Tactical Growth (Strategy 5)

Tactical Growth accounts were fully invested in equities at the beginning of the quarter. At the end of this week, the equity allocation is down to 60% with 5% invested in an Inverse Nasdaq fund, designed to increase in value if Nasdaq stocks continue to decline. The money market allocation has risen to 35%.

Sector Rotation (Strategy 6)

This strategy does move defensively during the month unless there is substantial and prolonged weakness in the market. So this strategy will ride through any short-term volatility, until the next recalibration time at the end of the month. As a result of the most recent rotation, the portfolios hold technology, biotechnology, health care, retail, industrials, and telecommunications funds.

Please remember to inform your advisor of any changes in your life that could affect your investment objective and how we manage your money or if you want to discuss your portfolios in light of this recent market volatility.

FSA Investment Team

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Financial Services Advisory, or any non-investment related content, made reference to directly or indirectly in this newsletter) will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions or applicable laws, the content may no longer be reflective of current opinions or positions.

The FSA Safety Net® is designed to represent an exit point for each security within a portfolio and to help reduce losses from sustained drops in the financial markets. The FSA Safety Net® is not effective and will not protect assets in abrupt/sudden market drops. Examples of such occurrences include, but are not limited to, the market crash of October 1987, the market drop in October 1989, the market disruption caused by the terrorist attacks of September 2001, and the flash crash of May 2010. Similar future occurrences could reduce the effectiveness of the FSA Safety Net®. In addition, the FSA Safety Net® will not protect assets in the event mutual fund companies, custodial companies, or the securities exchanges themselves, at their discretion, suspend, disallow, or fail to conduct trades, redemptions, or liquidations.

Inverse/Enhanced investments: FSA may utilize inverse (short) mutual funds and/or exchange-traded investments/funds (ETFs) that are designed to perform in an inverse (opposite) relationship to certain market indices (at a rate of one or more times the inverse result of the corresponding index). In addition, FSA may also use leveraged (enhanced) mutual funds or ETFs that provide an enhanced relationship to certain market indices (at a rate of more than one times the actual result of the corresponding index). There can be no assurance that any such investment will prove profitable or successful. In light of these enhanced risks/rewards, clients may direct FSA, in writing, not to employ any or all such investments.

Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from FSA.

Financial Services Advisory is neither a law firm, accounting firm nor insurance agency and no portion of this newsletter should be construed as legal, tax, insurance or accounting advice. FSA advisors are not attorneys, accountants, insurance agents or comprehensive financial planners and no portion of its services should be construed as legal, accounting, insurance, or tax advice.

For further details, including FSA’s current Disclosure Brochure discussing our advisory services and fees, please see important disclosures at www.FSAinvest.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement.

Please remember that it remains your responsibility to advise FSA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.