Amidst this year’s focus on the COVID-19 pandemic and recent U.S. presidential election, America’s oldest stock market index underwent a significant change. The Dow Jones Industrial Average, or simply “The Dow,” had three of its components replaced. It is already noteworthy when one of these thirty coveted spots in the index changes hands, so replacing three simultaneously merits a further look.

First, let’s discuss what makes the Dow unique. Launched in 1896 by Charles Dow, it has long held significance to Americans as being synonymous with the overall U.S. stock market. When you hear your neighbor ask, “Did you see what the market did today? It was down over 1000 points!” they are likely referring to the Dow. Despite its continued prominence, the Dow has a couple of key drawbacks. First, being an exclusive club of just 30 companies constrains it from more accurately representing both the overall domestic stock market and the American economy. When the Dow was first launched, including only 30 of the largest companies could more adequately represent the American economy than it can today as our economy is now significantly larger and more complex than ever.

A second drawback is that it is a price-weighted index versus a capitalization-weighted index which means that a component with a higher price per share will have more of an influence on the performance of the index, regardless of the company’s actual market value (also known as market capitalization which is found by multiplying the total number of shares a company has issued by the current price per share). This is different from most other major indexes such as the S&P 500 where the market capitalization of a company dictates its influence on the performance of the index and not just the price per share.

For these reasons, many professional investors will opt to reference a broader capitalization-weighted index such as the S&P 500 or the Russell 3000 to gauge overall U.S. stock market performance. Regardless of the Dow’s drawbacks as an index, its enduring popularity means investors should stay informed of any changes it undergoes.

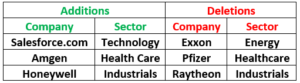

So what changed? This past August, S&P Global, the parent company of the Dow, announced that Salesforce.com, Amgen, and Honeywell International would be joining the index, while Exxon, Pfizer, and Raytheon Technologies would be departing.

S&P Global stated that these component changes were prompted in part by Apple’s decision to split their stock 4 for 1, meaning the price of Apple went from approximately $400 per share to $100 per share. (If you are interested in learning more about stock splits, FSA recently published a Technical Tuesdays video on the topic that can be found by clicking here.) In a price-weighted index such as the Dow, this now means that Apple has a quarter of the influence on the Dow’s performance as it did prior to the split, whereas in a capitalization-weighted index such as the S&P 500, Apple would retain the same influence regardless of its share price.

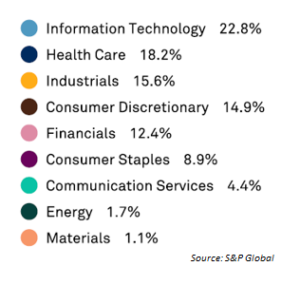

In order to rebalance the technology sector back to an appropriate weighting, S&P Global added another technology company while removing Exxon. This is symbolic of the changing U.S. economy as Exxon had been the longest-standing member of the Dow, originally joining as Standard Oil in the 1920s. The American economy has been moving away from the energy and industrial sectors and more towards a service-based economy comprised in large part by technology companies for quite some time, with this shake-up as another reminder of this continued economic shift. Despite Exxon’s departure, the energy sector will continue to be represented by Chevron. For a complete history of the Dow’s components, the Visual Capitalist has a great graphic that can be found by clicking here. A current sector weighting break-down of the Dow following this year’s rebalancing is below:

In a free market economy, we should expect that the winners of today will replace the winners of yesterday, and that is exactly what is happening here. Still, the significance cannot be understated. It wasn’t that long ago that Exxon was the largest American company by market capitalization, only to have been surpassed by several large technology companies in recent years. Economic trends will always be in a fluid and evolving state, which makes one wonder what the top sector in another century might be. Perhaps it’s something we have never even heard of yet in the same way Charles Dow didn’t know what “cloud computing” was. For now, it’s exciting just to be living through market history.

Portfolio Update

With the election finally behind us, the market now has one less event to worry about. The month of November in election years has historically been strong, and at least in this way, 2020 has not deviated from this trend. In fact, major indexes were up better than 10%, the strongest month for the Dow since January of 1987. As such, we deployed some cash that we had built up prior to the election. With overall market trends up and rising, and seasonal tendencies positive, we are content to let the portfolios ride the bull wave.

Derek Kravitz

Investment Analyst

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.