How quickly things can change. There is a Chinese saying (or curse) that says, “May you live in interesting times.” Well, these certainly qualify as interesting times. Three months ago, global economic growth was on a steady if not consistent climb upward with the world stock markets leading them along. Then we began to get word of a novel virus out of central China that started to spread. As we reported in an earlier newsletter, however, the markets do not generally react too negatively to scares of this kind. Well, that obviously has not been the case this time.

As the world has gone into self-imposed lockdown to prevent the spread of the novel coronavirus, global economic output has ground to a halt. Not surprisingly, global stock markets have made a hasty retreat. In fact, from the all-time high hit on February 19, the S&P 500 index of large U.S. companies has fallen over 30% at its low (and was down over 20% at the end of March). This was the fastest bear market drop (over 20%) from a market high—ever.

In an effort to keep the virus from completely tanking the economy, the government has come in with guns blazing. The Federal Reserve cut interest rates to virtually zero and has injected liquidity into the financial system. The President and Congress have passed an enormous $2 trillion spending package to help those affected by the virus. The extent of the government’s response to this crisis is unprecedented.

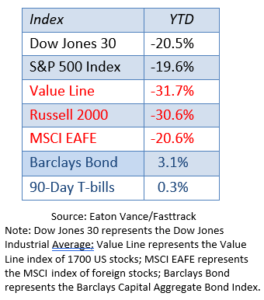

The table below shows the damage done in the first quarter, among a variety of stock and bond indices:

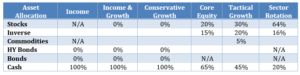

As you probably know by now, the FSA Safety Nets® were triggered across all of our equity and bond positions, and most funds have either been sold or hedged out by an inverse fund. The table below shows the broad asset allocation of our six strategies:

While we were close to these levels of money market allocations in the fourth quarter of 2018, the present FSA strategies are more defensive than they have ever been since 2008. Our more aggressive strategies continue to include some modest amounts of equity, but these are largely offset by inverse funds (which are designed to go up when the markets go down). Even the Sector Rotation strategy, which is designed to generally stay fully invested, has a fairly conservative risk profile.

Why We Do What We Do

This incredibly swift and violent sell-off, coming just after stocks hit an all-time high, illustrates exactly why we manage money the way we do. There is no fundamental research or macro trends that could have forecast this global market development. It is only by having a process in place that focuses on the price trends of our individual holdings, as well as the discipline to act swiftly, that allowed our portfolios to get defensive, with a fraction of the losses from the broad stock market.

Our approach is designed to protect the portfolios when conditions deteriorate so that small losses don’t turn into large losses. Of course, we all have different standards of what constitutes a “large loss,” which is why we have different strategies to match your return expectations with your tolerance for risk. Our goal is to give you peace of mind by providing a smoother journey.

What Next?

Since we have pulled the portfolios out of “the choppy waters and onto the beach,” some of you may be wondering at what point we should begin to reinvest in the stock and/or bond markets. As you might expect, we will look to be more opportunistic in the more aggressive strategies (Sector Rotation, Tactical Growth, Core Equity), while waiting patiently for clearer signs of a positive turn to guide movement in the more conservative strategies (Conservative Growth, Income & Growth, Income). It might happen that we see conditions improving in the bond market before they do in the stock market as occurred in early 2009.

Without getting into the details here of what conditions will spur us to begin reinvesting (a topic for future updates), suffice it to say that considerable damage has been done in both the stock and bond markets. As a trend-following firm, we will let price trends provide the timetable for our re-entry into the stock and bond markets. No doubt, we will wade back in prudently, rather than diving in all at once.

Portfolio Update

Keep in mind that because we manage clients’ portfolios individually, the holdings in your particular accounts may differ somewhat from the averages.

Income (Strategy 1)

Typically, when conditions get rough in the stock market, the bond market is a good place of shelter. And that was true for most of the last quarter. However, there was a stretch of seven days in March that rocked the bond market, sending some high-quality funds down over 20%, with even the staid Barclays Aggregate index down over 9%. Our FSA Safety Nets® were triggered, and we pulled the portfolios to 100% money market funds by March 18.

Income & Growth (Strategy 2)

As in the Income strategy, we were forced out of bonds, as well as stocks, by mid-March. Now that the portfolios are 100% in money markets, we can wait patiently for the right opportunity to begin moving back into the equity and/or bond markets.

Conservative Growth (Strategy 3)

These portfolios are sitting comfortably in 100% money market funds and have been for several weeks. The swiftness of the decline in stocks made the process of moving to cash more challenging, as did the atypical bond market disruptions. At this point, we have plenty of dry powder to take advantage of whatever opportunities present themselves in the weeks or months ahead.

Core Equity (Strategy 4)

The speed and sharpness of the decline made the execution of the FSA Safety Nets® more difficult than usual, but the portfolios have been fully protected since mid-March. While some portfolios continue to hold one or two stock funds, those positions are offset by an inverse fund. If stocks break the lows set in late March, we will exit those funds and put those proceeds into money markets.

Tactical Growth (Strategy 5)

Even though these portfolios are mostly in cash, they do hold a few equity funds (such as a health care fund), as well as some inverse funds, which go up on days when the stock market is down. These accounts also own gold which managed to hold up in the March sell-off. Because this is our most opportunistic strategy, we will be looking for other areas to invest in as the weeks unfold.

Sector Rotation (Strategy 6)

Unlike our other strategies, Sector Rotation continues to maintain a sizable invested position. Nevertheless, even this strategy is more defensive than usual. In the March rotation, these portfolios held an S&P inverse fund which helped cushion the drop in value. For the April rotation, the portfolios also include a higher allocation to money market funds (now at 20%) to go along with the inverse fund and the four sector funds: technology, internet, telecommunications, and health care.

Please remember to inform your advisor of any changes in your life that could affect your investment objective and how we manage your money.

Final Note

We would like to take this opportunity to welcome a group of new clients to FSA. The clients of Dolan Financial Corporation officially joined the FSA family on April 1 as their long-time advisor was looking to retire after a successful career of nearly 40 years. He wanted to find a good home for them, and we are pleased and honored to have them join us. We hope to provide the same strong financial partnership as they experienced at Dolan Financial Corporation.

In closing, these are truly tough times for many, and we thank you for your confidence in us. If you have any family, friends or colleagues who need help during these uncertain times, your advisor would welcome a chance to have a conversation with them.

Stay safe and stay healthy.

Ronald Rough, CFA

Chief Investment Officer

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.