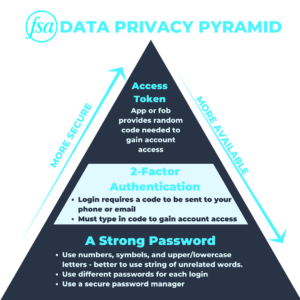

Data privacy becomes more important as technology advances and more of our information is available online. Long gone are the days of waiting for monthly account statements – The FSA Vault allows you to view your account on a daily basis. While we all enjoy the ability to view our balances at any time, keeping our information in the internet jungle puts our assets at risk. We created the pyramid below to acquaint you with some valuable tools available to increase your data privacy.

Data Privacy Foundation: A Strong Password

Your first and most basic data privacy line of defense is a strong password – one that uses numbers, symbols, and uppercase and lowercase letters and does not use obvious personal information like your date of birth or anniversary. The hardest passwords to uncover consist of a random string of words, such as c0w$hoeDesk. The less the words are related, the better.

As easy as it is to use the same password for all of your online accounts, if a hacker guesses your go-to password, suddenly your entire online identity is compromised. By using different passwords for different websites, a hacker cannot automatically access all of your accounts by uncovering just one of your passwords.

To keep track of all of these passwords, we suggest you use a secure password manager, such as LastPass (www.lastpass.com) or 1Password (www.1password.com). These tools allow you to use complicated passwords without having to remember all of them or keep a list that can easily be found.

The Next Step in Data Privacy: Two-Factor Authentication

As hacker technology gets better at uncovering passwords, demand grows for higher security measures when it comes to data privacy. As a result, two-factor authentication (2FA) is becoming more widely used.

2FA requires another authentication step in addition to entering your password correctly. Many institutions require you to enter a code that they text or email to the phone number or email address they have on file for you. Once you type in the code correctly, access to your account is granted.

Two-factor authentication protects you if your username or password information is compromised because the thief would also need access to your cell phone or email address to gain access to your account (emphasizing the importance of using different passwords for different accounts).

The Future of Data Privacy: Access Tokens

For those who really want to take data privacy seriously, ask the companies you do business with if they offer an access token. Similar to 2FA, an access token requires a random code to be entered in addition to your password every time you log in. Instead of the code being texted or emailed to you, however, the code is generated by a separate device, such as an app or a fob. This code changes each time you log in.

There is no known way to duplicate your token; therefore, a hacker needs not only your password but also your personal token to gain access to your account. Charles Schwab offers free access tokens that can be used to log into your Schwab Alliance online accounts. To order a free token, please call Charles Schwab at (800) 435-4000.

Feel free to give us a call for more information or for more suggestions of how to keep your data privacy safe and secure.

Download the fsa data privacy cheat sheet!

Sources:

Charles Schwab (2019). SchwabSafe. https://www.schwab.com/public/schwab/nn/legal_compliance/schwabsafe.

Douglas, Nick (2017, August 14). How to Create a Strong Password. https://lifehacker.com/how-to-create-a-strong-password-1797681069.

Rouse, Margaret (2018, August). Two-Factor Authentication (2FA). https://searchsecurity.techtarget.com/definition/two-factor-authentication.

To view our disclosures, including our disclosure brochure, please visit www.FSAinvest.com/disclosures.