The S&P 500 index finished the month down 9%, the worst December decline since 1931, during the Great Depression. As of Christmas Eve, stocks were down 15% for the month, and then a furious 7% pop in the final few days of the month enabled stocks to recover a bit. To borrow the immortal words of Dr. Seuss, the month of December can best be described as “Stink, Stank, Stunk!”

Historically, stocks typically do well in December. In fact, looking at data back to 1950, the Stock Traders Almanac lists December as the strongest month of the year for the S&P 500 index and the second strongest month for the Nasdaq Composite. So, this historical tendency makes the year-end drop even more surprising.

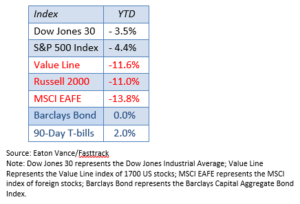

For the year as a whole, the S&P 500 index had its first negative annual performance since 2008. The index, whose returns are dominated by the largest handful of companies, fell over 4% for the year. Most areas of the market experienced double-digit losses, including foreign stocks, small-cap stocks, and commodities.

Among the 11 sectors within the S&P 500 index, only four managed a positive return for the year. The best returns for the year came from health care stocks, though they were up less than 5%. Five of the eleven sectors finished the year down greater than 10%.

Bonds provided no lift either. The Barclays Aggregate index of high quality bonds was flat for the year, while the more credit-sensitive high yield bond indexes were down slightly.

One might have expected gold to offer a safe haven, since neither stocks nor bonds could provide a positive return; however, even gold was down slightly in 2018. What about Bitcoin and other cryptocurrencies that were touted as the revolutionary new asset class for the new millennium? Bitcoin rose over 1000% in 2017 ($1,000 became $10,000), but then promptly fell 80% last year ($10,000 became $2,000), so cryptocurrencies looked more like a bubble than a safe haven. The winner of the asset class comparisons for 2018 was actually—CASH. Cash was king in 2018. Since the Federal Reserve raised interest rates last year, an investor can now get a return of over 2%, not too bad considering the zero percent returns we saw in cash-oriented investments in past years.

What May Lie Ahead

So, who is playing the role of the Grinch in our story? Is it Jay Powell, the chair of the Federal Reserve, for continuing to push up short-term interest rates while signs of economic growth are moderating? Is it President Trump or Chinese President Xi Jinping for escalating the trade war? Maybe Congress should hold that mantle due to the government shutdown. As far as the market is concerned, all of these players are taking on the role of the Grinch. All of these characters are contributing to the new narrative on Wall Street that the global economy is slowing and it is the actions of these players that are causing it to happen.

As of year-end, the FSA portfolios have minimal allocations to equities. Most equity investments have tripped through their FSA Safety Nets®, while several of our bond investments have managed to hold above their exit points. In addition, as the money market allocations have been growing, we have been moving more of that allocation into the higher yielding money market funds rather than the FDIC-insured cash sweep vehicle. This should allow the portfolios to generate a little interest income while we wait for the waters to calm.

Of course, in the end, How the Grinch Stole Christmas is a redemption story, so we’ll leave you with this thought: with stocks finishing 2018 in such bad shape, the stage may be set for some upside surprises in 2019. As long as the overall economy can maintain some strength, there is room for stocks to rally in the New Year.

Portfolio Update

Keep in mind that because we manage clients’ portfolios individually, the results for your particular accounts may differ somewhat from the averages.

Income (Strategy 1)

Bonds languished all year as the Federal Reserve continued to bump up short-term interest rates. But as stocks sold off in December, bonds managed a small recovery and finished the year essentially flat. As bonds began to recover, we added a high-quality bond fund to the portfolios in mid-December. As of year-end, these portfolios are roughly 65% invested, with 35% in money market funds.

Income & Growth (Strategy 2)

This diversified strategy held up very well in the December sell-off, in part because we had sold the remaining equity position early in December. So, the portfolio held cash and bonds for most of the month. We added a high-quality bond fund in mid-December, as these bonds had started to rally. As of year-end, these portfolios hold 35% in bonds and 65% in money markets.

Conservative Growth (Strategy 3)

This moderate strategy entered the month of December in a defensive posture, with 25% in equities, 10% in an inverse fund (goes up when markets go down), and 50% in money markets. As a result, it held up very well as stocks fell nearly 10% for the month. During the month, we exited the remaining high yield and floating rate funds as those areas of the bond market continued to weaken. As of year-end, this strategy held 15% in stock funds, 10% in an inverse fund, and 75% in money markets.

Core Equity (Strategy 4)

At the start of December, this equity strategy had already assumed a defensive posture, with 45% in equities, 5% in an inverse fund (goes up when markets go down), and 50% in money market funds. During the month, we sold the health care fund, along with two other large-cap funds, while adding a small allocation to gold. Heading into January, these portfolios only held 20% in equities, 10% in an inverse fund, and 65%-70% in money market funds.

Tactical Growth (Strategy 5)

This eclectic strategy was quite defensive at the beginning of December, with only 35% in equities, along with 65% in money market funds. As the market continued to roll over in December, we sold the 20% invested in large-cap U.S equities, as well as the telecommunications sector fund. In addition, we added a position in gold and an inverse small-cap fund. At year-end, we held only 10% in equities, along with 10% in an inverse fund, 10% in gold, and 65% in money market funds.

Sector Rotation (Strategy 6)

During the November rotation, this strategy picked up an inverse fund, which acted as a cushion during the December decline. As a result of the most recent rotation, the portfolios hold technology, health care, telecommunications, precious metals, and an S&P 500 inverse fund, as well as an extra allocation to money markets.

Please remember to inform your advisor of any changes in your life that could affect your investment objective and how we manage your money or if you want to discuss your portfolios in light of this ongoing market volatility.

FSA Investment Team

Disclosures: Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. It should not be assumed that future performance of any specific investment, investment strategy or product (including the investments and/or investment strategies recommended and/or undertaken by FSA or the FSA Safety Net®), or any non-investment related services, content or advice, will prove successful or profitable, or equal any historical performance level(s).

The FSA Safety Net® is designed to represent an exit point for securities within a portfolio to help reduce losses during sustained downward trends. The FSA Safety Net® is not effective and will not protect assets in periods leading up to and including abrupt/sudden market downtrends. Examples of such occurrences include, but are not limited to, the market crash of October 1987, the market drop in October 1989, the market disruption caused by the terrorist attacks of September 2001 and the flash crash of May 2010. Similar future occurrences could reduce the effectiveness of the FSA Safety Net®. In addition, the FSA Safety Net® will not protect assets in the event that the account custodian, mutual fund sponsor or manager, annuity sponsor or manager, a specific security itself and/or the stock exchanges, at their discretion, suspends, disallows, or fails to conduct trades, exchanges, redemptions or liquidations requested by FSA or you.

Inverse/Enhanced investments: FSA may utilize inverse (short) mutual funds and/or exchange-traded investments/funds (ETFs) that are designed to perform in an inverse (opposite) relationship to certain market indices (at a rate of one or more times the inverse result of the corresponding index). In addition, FSA may also use leveraged (enhanced) mutual funds or ETFs that provide an enhanced relationship to certain market indices (at a rate of more than one times the actual result of the corresponding index). You may direct FSA, in writing, not to employ any or all such investments.

Due to various factors, including changing market conditions or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this communication serves as the receipt of, or as a substitute for, personalized investment advice from FSA.

FSA is not a law firm, accounting firm or an insurance agency, and no portion of FSA’s services should be construed as comprehensive financial planning or legal, insurance or accounting advice. Rather, you should seek the advice of your attorney, insurance agent, accountant or other corresponding professional advisor with respect to such issues.

Please remember it is your exclusive obligation and sole responsibility to immediately notify FSA, in writing, if there is a change in your financial situation or investment objective(s) including, but not limited to, personal/financial situation, goals, needs or concerns/views regarding economic/political/financial climate as well as any changes in investment alternatives, restrictions, etc. for the purpose of reviewing, evaluating or revising any of FSA’s previous recommendations and/or services.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is available at www.FSAinvest.com/disclosures or by calling 301-949-7300.