Last year is a hard act for stocks to follow. After the equity market’s strong performance in 2019, it would not have been surprising to see stocks take a breather and move sideways in the new year. That would have given investors a chance to “digest” the market’s gains and reset expectations for 2020. But January took up the baton from December, and stocks forged ahead—that is, until the end of the month.

Through most of January, the stock market shrugged off concerns about President Trump’s impeachment trial and a virus originating in China. But in the end, fears stoked by the coronavirus won out, leaving both the Dow and S&P 500 in slightly negative territory for the month. As stocks retreated at the end of the month, high-quality bonds surged, with the average U.S. bond up almost 2%.

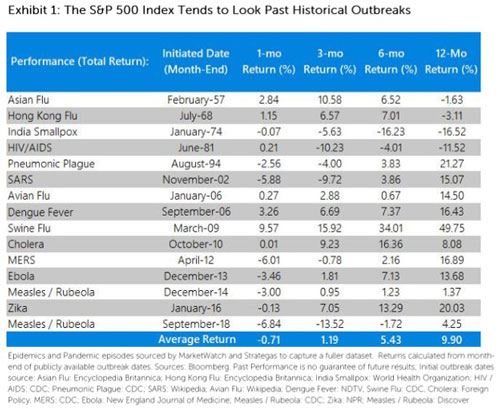

The coronavirus outbreak is what some might consider a “black swan” event—an unpredictable incident that seems to come out of nowhere, with potentially severe consequences. But epidemics are not new. Since 2000, the world has seen several outbreaks of contagious diseases: SARS, the swine flu, and the Ebola and Zika viruses, to name a few. While we might recall how scary these seemed at the time, we might not remember how equity markets fared during those outbreaks.

The chart below is a visual of how the S&P 500 Index performed during past epidemics, from one month out to twelve months after the viruses first appeared.

For the most part, the S&P 500 bounced back following short-term negative impacts once fears quieted down. Of course, past performance isn’t a guarantee of how U.S. stocks will react to the current health crisis, but history can provide a useful perspective. Other factors, such as whether the U.S. was in a recession at the time, seems to have had a greater impact on equity performance than the epidemics themselves.

More meaningful than stock market returns, of course, is the human side of the story. While we remain vigilant about possible negative impact on portfolios, more importantly, we wish good health for our clients with minimal impact from the coronavirus.

Mary Ann Drucker

Assistant Portfolio Manager

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.