Are you retired or nearing retirement? Are you nervous about a stock market sell-off affecting your retirement income? Do you want a smoother investing journey with fewer ups and downs? If you said yes to any of these questions, investing with a “safety net” may benefit you! In this month’s blog post, we are going to briefly cover the FSA Safety Net® and some of the benefits it could provide for you.

What is the FSA Safety Net®?

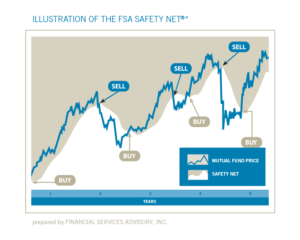

From over three decades of investment experience, we’ve learned that portfolio losses have a greater impact on total performance than gains. For example, a 50% loss must be followed by a 100% gain just to get back to break-even. The FSA Safety Net® is designed to represent an exit point for each individual security in your portfolio. If the individual funds we invest in decline in price and hit our customized exit points, we will move defensively into safer assets until the trend in riskier assets reverses. The goal is to prevent small losses from becoming major

losses.

Each fund in a client portfolio receives a uniquely tailored “safety net” based on their individual trends and the market climate. For example, a less risky bond fund will have a tighter “safety net” than a technology fund that needs a little more wiggle room for us to capture their gains.

A Smooth Journey

A feature of the “safety net” is that it helps create a softer investment journey and can minimize investment headaches. Historic market corrections such as the Tech Bubble of 2001 or the Financial Crisis of 2008 don’t seem as scary when your investment accounts are in safer investments while the markets are still falling. This is where the smoothing effects of the FSA Safety Net® really shine.

Peace of Mind

Having peace of mind is one aspect of life that is truly priceless. Even once retired, there are a lot of things to worry about without having to wonder how a stock market decline could alter your retirement. We try to limit clients’ concerns about the stock market by always having an exit strategy if things get ugly. Knowing that there is a game plan in good markets and bad markets can provide comfort and let you spend more energy focusing on living your life.

Investing in Retirement

Deciding when to retire can be nerve-wracking. If you retire and a market crash occurs shortly thereafter, your retirement plan could be thrown into disarray. Having a plan for when these downturns occur makes a difference in the decision on when to retire. Upon reaching retirement age, it is wise to change your investing style. In most cases, retirees and pre-retirees are at a point where preserving their nest egg is more important than aggressive growth.

The goal of the FSA Safety Net® is to react to market conditions rather than predicting them. We do not have a crystal ball telling us where the market is going next, but by following the money and paying close attention to our FSA Safety Nets®, we can be in the market when the waters are calm and safe on the beach when the water gets choppy.

If you have any questions about our FSA Safety Net® approach, feel free to email us at Questions@FSAinvest.com or give us a call at (301) 949-7300. We are here to help you find some investing peace of mind!

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.