The Washington DC area went through a dry spell in August/September, with rainfall well below its long-term average. For the typical resident, dry weather is preferable to wet weather since rain curtails outside activities and makes travel more difficult. Nevertheless, while we like clear sunny days, if we never get rain, that isn’t a good outcome either. Just ask the residents in the southwest who are struggling through an epic drought. It is rain that brings nourishment.

Bull markets are similar to sunny weather. It makes everyone happy, but again, too much of a good thing is actually bad. Markets that continue to go up month after month and year after year lead to conditions that are actually quite unhealthy. Stocks get overvalued and investors get overconfident and believe stocks will always move up. As a result, corrections are a necessary and even needed part of the overall market cycle. It is the corrections that bring ‘nourishment’ back to the markets by bringing valuations down and toning down investor greed and complacency.

So even though we prefer sunny days to rainy days, we recognize that we need the rain to maintain a proper balance. The same goes with market cycles. While we prefer the profits that occur during the bull markets, we know that it is the corrections that help keep the overall market cycle healthy.

To carry on the analogy, we have had a long stretch of dry sunny weather in the U.S. stock market going on four years. In fact, the S&P 500 index hasn’t posted even a negative return since the fourth quarter of 2012, so, we were certainly overdue for a pullback of some magnitude. Even though no one likes a correction, we could really use one to help correct some excesses in the markets.

Well, it seems like we are in the middle of one right now. U.S. stocks stalled out this spring and rolled over in late August. After attempting to rally back in the first half of September, stocks went down again and we finished the quarter near the lows reached in late August.

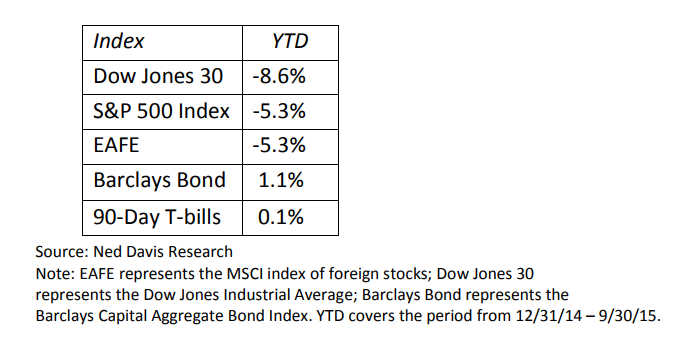

The result is that most asset classes and sectors are now in negative territory for the year. This includes U.S. treasuries, which would typically benefit from investors fleeing the stock market (See table below).

Prospects Through Year End

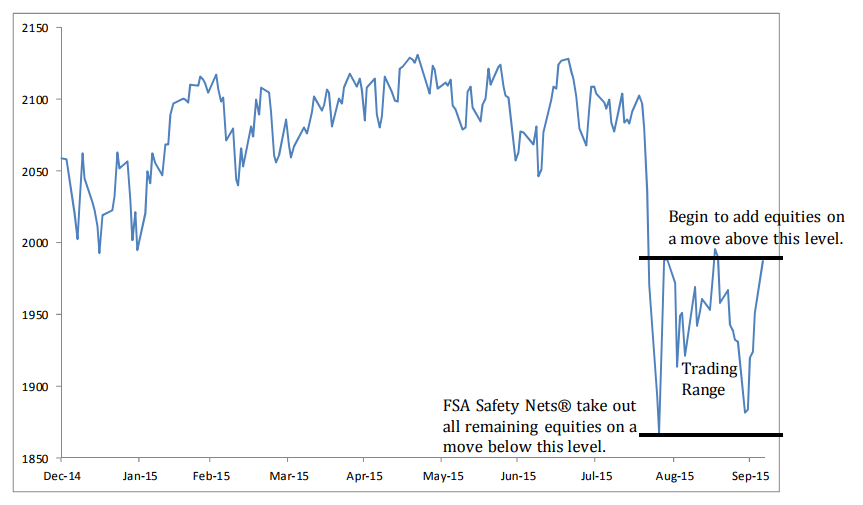

From our perspective, stock trends have begun to turn down, which is why you’ve seen us building cash in your portfolios. Across all five strategies, we have approximately 60% in money market funds. In addition, we hold almost 20% in bond funds. This leaves us with only about 20% in stock funds. At this point, if stocks can manage to hold the low levels hit during the quarter, we will maintain our current position. If stocks can break above the recent trading range, we will begin to prudently add some stock or bond positions. And of course, if stocks break lower from these levels, all of the FSA Safety Nets® will be triggered and we would sell any remaining stock funds (see chart below).

The long stretch of dry, sunny weather appears to have come to an end. While we need this change of seasons, given our prudent nature and concern about market losses, we plan to keep a pretty conservative posture as long as the overall stock market trends are showing a downward bias. While we recognize that these corrections are necessary to keep the overall market healthy, it doesn’t mean we have to like them.

Portfolio Review

Below we review the five broad strategies that FSA manages. Keep in mind that your specific portfolio may differ to some degree from the averages, as our portfolios are individually managed.

Income (Strategy #1)

Fortunately, bonds have been spared from most of the turmoil that has plagued stocks around the world; nevertheless, there has not been much interest in buying bonds either. No doubt, there is concern about the Federal Reserve raising interest rates, so the performance of most bonds is fairly flat. We sold the high yield bond fund during the quarter as those types of bonds tend to move as stocks move. Currently, the money market position in this strategy is 40%.

Income & Growth (Strategy #2)

As the environment got more volatile for stocks in the third quarter, we began to reduce our equity positions in this conservative balanced strategy. Even though the equity funds in this strategy were defensive by nature, we took the overall equity allocation from 45% down to 15%. Since bonds held up in the third quarter, we maintained those positions. This strategy has held up quite nicely during the stock market turmoil.

Conservative Growth (Strategy #3)

We have moved pretty consistently to build up the money market allocation in Conservative Growth during the quarter, with the stock allocation dropping from 60% – 65% down to 10% – 20%. We completely exited the international and global funds as those funds fell more quickly. The remaining positions are all lower risk funds that have held up relatively well. We left the bond allocation alone as those funds have held up just fine during the quarter. Currently, Conservative Growth portfolios hold between 50% – 70% in money market funds.

Core Equity (Strategy #4)

We spent a good deal of time, particularly in the second half of the quarter, bringing down the equity allocation as the market turmoil unfolded. Specifically, we reduced the allocation to equities from 65% – 80% down to 10% – 25%. This included our international funds, as well as health care and technology funds. If stocks can break out of their recent trading range, we will look to add equities back to the portfolios. Conversely, if stocks break down below their recent lows, we will sell all remaining stock funds to money market.

Tactical Growth (Strategy #5)

The increase in market volatility led to increased trading in Tactical Growth. Fortunately, the choppiness from the second quarter already led us to trim back some areas. Nevertheless, as the market began to roll over in late August, we brought down the overall equity allocation from roughly 60% to 15% at quarter end. This included our foreign positions, as well Biotechnology and high yield bonds. As of quarter end, the money market position is 75%.

FSA Investment Team