May Market Review From Your Portfolio Management Team — June 9, 2011

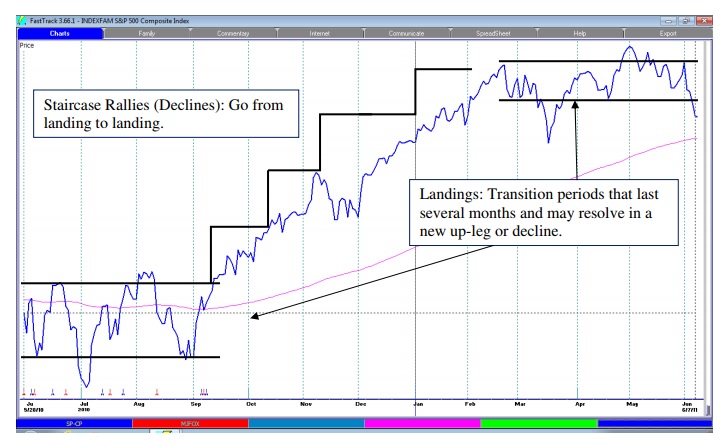

Is the stock market rolling over into another bear market or is this just a healthy pause in an ongoing bull market? We seem to hear many arguments from either side these days. Look at the chart below of the S&P 500 index. To some, the market remains in a healthy uptrend (above the 200-day moving average — the pink line in the chart), while to others it appears to have stalled out since mid-February, and may be on the verge of a move back to the 200-day moving average (or even lower).

It’s all a matter of perspective. If you tend to focus on what problems are facing investors, then you may see the graph above through a negative lens; whereas, if you focus on the progress made from early 2009, then you may see stocks in a more positive light.

From our vantage point, we see periods like the past four months as periods of transition. The market has been moving strongly since early September and is digesting those gains while deciding if the corporate and economic evidence is strong enough to warrant further gains. This is fairly typical behavior for the stock market. When there is positive news reaching investors, stocks tend to move up in a staircase-like fashion, and then the market will consolidate those gains until new evidence comes in to either support or reverse those gains. These periods can be very frustrating for investors as the market treads water for several months at a time.

Since mid-February when the S&P 500 index closed at 1343, the market has been in a fairly narrow range of 1300 – 1345, breaking to the downside briefly in mid-March, and breaking to a slightly higher high in late April.

Stocks have struggled to move higher recently as some reports suggest that economic growth is stalling, and along with it employment growth. This ‘soft patch’ is most likely due to the fallout from the earthquake and nuclear accident in Japan, as well as higher oil prices, which are diverting consumer dollars away from discretionary items like vacations, cars, and plasma screen televisions. What has investors scratching their heads is deciding if this slowdown is indeed just a soft patch in an otherwise ongoing recovery, or if the recovery is indeed stalling out. Complicating matters is concern over how healthy the economy will be if the Fed ends the so-called QE2 (second round of quantitative easing—an effort to flood the system with liquidity to help the economy recover). On the global front, there is continued concern with the debt problems in Greece and the potential spillover effects there will be throughout Europe, not to mention the ongoing political turmoil in Libya and other Middle Eastern countries. Frankly, it is somewhat amazing (and maybe even encouraging) that the stock market continues to behave as well as it has given the global uncertainties in the public consciousness today.

These landings or transition periods are important not only for determining the next direction in stock prices, but they also offer clues as to the leadership during the next move. As a result, we spend a good deal of time trying to find which areas are getting the significant money flows. What we see, so far, is the areas that generated the most interest in the first quarter (commodities, energy stocks, small-cap stocks) have also been hit the hardest in the correction. Areas that have held up the best include health care, consumer staples, utilities, and real estate securities—not too surprising given the more defensive nature of these sectors. Tactical Growth clients already have real estate, consumer staples, and biotechnology in their portfolios. In the other strategies, we opted for more conservative funds that focus on generating dividends. Although they have lost ground during the correction, they have held up better than the broad market.

If stocks break below 1250 on the S&P 500 index, we will get the portfolios quite defensive by scaling back the more aggressive positions. On the other hand, if the news improves and stocks break higher from this landing, we may look to add small-cap or energy funds to our current mix of funds.

Summer is often seen as a quieter period for the markets as investors and institutional traders take vacations. As a result, we may find ourselves on this current landing for awhile longer. Regardless of whether the glass is half full or half empty, there is ample water to quench our thirst. (Translation—there are ample opportunities to meet our goals if we remain patient and prudent.)