Voters have spoken, and a majority felt a change was needed, with Joe Biden succeeding Donald Trump as President. Interestingly, voters did not want too much change as it appears that the Republicans will maintain control of the Senate and even picked up a few seats in the House of Representatives. The result should not have been too unexpected as years with recessions (even self-imposed versions) or years with unusual stresses to the economy (such as a pandemic) are usually met with a change in leadership.

Of course, Trump has vowed to take the fight to court as his administration has claimed voter fraud in several of the key battleground states. Given the unprecedented year we have all experienced, it seems only fitting that the election results would remain under a cloud. The year 2020 will no doubt live on in infamy for many reasons.

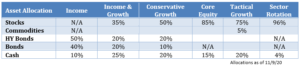

Heading into the election, the portfolios were positioned to participate if the knee-jerk reaction were to the upside, while at the same time provide a cushion with cash or an inverse position if the reaction were to the downside. With stocks surprising almost everyone by rallying strongly in the first week of November, we have begun to bring the portfolios back to more fully invested positions, as shown in the table below.

Stocks continue to churn back and forth since the highs hit by the S&P 500 on September 2. Until stocks can make a sustained break above those levels, we consider them to be in a so-called “landing,” looking for a catalyst to send them to new highs or down into another correction. In spite of the strong bounce to start the month of November, there are plenty of challenges ahead for the economy and the stock and bond markets, so we will continue to monitor the FSA Safety Nets® and make sure to keep the portfolios in synch with the primary market trends.

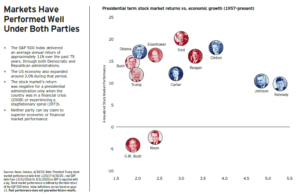

For those who believe that one party or the other has a better influence on the stock market, we will leave you with some positive evidence no matter which political party ended up in the White House. The graph below from Invesco demonstrates that stock market performance is not dependent on which political party is in power. Historically, equities have performed well under both Republican and Democratic administrations:

On another topic, given that the end of the year is near, we want to take this opportunity to remind you of something that happens every year around this time: mutual funds pay out capital gain distributions in November and December. Some of you might recall this annual ritual from years past. But we wanted to bring it up since you might notice one or more of your fund positions drop in value more than you’d expect on a given day. Those drops will be adjusted by Schwab over the ensuing few days as the dividend gets reinvested.

Finally, we wish you and your families a wonderful and safe Thanksgiving holiday, and we’re grateful for the trust that you continue to place in us.

Your Investment Management Team

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.