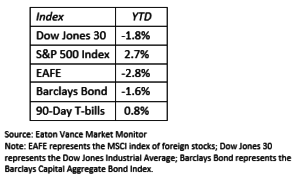

Stock and bond markets around the world are struggling to find direction in 2018. By this point last year, U.S. and foreign stocks were up by close to double digits, and bonds were up over 2% (respectable given their low yields). This year is a different environment, as the table below highlights. While no broad index is down sharply, any gains the indices did enjoy were minimal. To be sure, there are some relatively strong areas such as small-cap stocks, as well as the large-cap growth stocks that tend to trade on the Nasdaq exchange. Commodities have done well in 2018, thanks primarily to the sharp rise in oil prices.

Foreign markets—emerging markets in particular—struggled in the second quarter, as the rhetoric around trade and tariffs escalated. While most analysts believe the U.S. will avoid an outright trade war with China or any other major country, there is enough saber rattling on the issue to keep investors on edge. Given the unpredictability of President Trump, investors can’t be certain that all the rhetoric is simply positioning and bluster. Additionally, the dollar rose against other currencies in the second quarter, which hurts the returns for U.S. investors holding foreign investments. As a result, U.S. investors pulled back on their overseas investments.

Despite the overall sideways stock markets (without much upside or downside movement), growth-oriented sectors, and technology in particular, performed well during the quarter. Energy stocks, one of the laggards in the first quarter, made a strong rebound in the second quarter, thanks to rising oil prices.

In the bond market, nearly all areas have struggled. With the Federal Reserve on a mission to increase short-term interest rates, no area of the bond market has fared well. That said, a few areas managed to eke out a positive return, including floating rate funds, high yield municipal funds, and mortgage-backed security funds.

Outlook for the Second Half of 2018

Most stocks remain in the trading range we discussed last quarter. The chart below is the same chart we used for the first quarter update. As you can see, stocks have been unable to break above the high in January or fall below the February low (the range between the blue horizontal lines).

From a seasonal standpoint, we have moved from a period (January – April) when stocks historically tend to perform well and are now in a period (May – October) when stock returns have been more difficult to achieve. This factor adds to the reasons we have for maintaining some of our money market positions until stocks break above the present trading range. The key for investors during these periods of choppiness is patience.

We continue to look for profitable opportunities even though the broad markets are stuck in this trading range. Overall, we have reasons to be optimistic as we move into the second half of the year. If, however, the trade rhetoric develops into a real trade war, we have the FSA Safety Nets® in place to help protect your portfolios.

Money Market Update

As Jim Joseph, our president, mentioned in his email to you last month, Schwab will be closing its various sweep money market funds over the next year or so and moving clients into its FDIC-insured Bank Sweep feature. (The sweep fund handles all cash flows into and out of your Schwab account.) Because the yield on Schwab’s FDIC-insured Bank Sweep feature is lower than their tradable money market funds, you may see two money market funds in your portfolios during periods of elevated cash levels. It is our intention to complete this process by the end of July.

Portfolio Review

Below, we review first quarter results in FSA’s six broad investment strategies. Keep in mind that because we manage clients’ portfolios individually, the results for your particular account may differ somewhat from the averages.

Income (Strategy 1)

Bonds continued to face headwinds in the second quarter as the Federal Reserve maintained its quest to increase short-term interest rates. Given this environment, we are on the lookout for the areas of strongest returns in the bond market. The portfolios in this strategy have about 40% in funds that own mortgage-backed securities, a sector of the bond market that has managed to post positive returns this year. High yield municipal bond funds have also been a relatively bright spot.

Income & Growth (Strategy 2)

With stocks remaining in the current trading range, we bumped up the equity allocation from 20% to 40% in a few diversified managed funds. Our bond allocation, still roughly the same around 55%, consists of high yield funds, mortgage-backed security funds, and floating rate funds—all among the stronger areas of the bond market. The money market position is about 5%.

Conservative Growth (Strategy 3)

There were no major changes in the allocation of assets to these portfolios in the second quarter with stock funds still making up about 50%. We did shift from international funds during the quarter to small-cap funds and large-cap growth funds. The overall bond allocation in this strategy remains around 25%, with roughly 25% in money markets funds.

Core Equity (Strategy 4)

As stocks slowly worked their way higher in the quarter, we reduced the money market allocation from roughly 40% to 20%. We sold the financial sector fund, the international fund, and the emerging markets fund while adding a small-cap fund and increasing our allocation to large-cap growth funds. Currently, Core Equity accounts are invested about 80% in stock funds.

Tactical Growth (Strategy 5)

As the volatility of the first quarter settled down in the second quarter, we reduced the money market allocation from 30% to 15%. We increased small-cap investments, as well as the allocation to large-cap growth funds (including technology, the strongest sector in 2018). In addition, we sold the emerging markets funds, as well as the VIX market hedge. Overall, these portfolios are nearly 85% invested in stock funds.

Sector Rotation (Strategy 6)

This disciplined strategy, which invests in the top six ranked sectors each month, has been consistently pulling in the technology-oriented sectors in 2018. In addition, energy started to bubble up in the second quarter. For the most recent rotation, we own technology, internet, retail, health care, energy, and real estate.

Please remember to inform your financial advisor of any changes in your life that could affect your investment objective and how we manage your money.

FSA INVESTMENT TEAM

Disclosures: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Financial Services Advisory, or any non-investment related content, made reference to directly or indirectly in this newsletter) will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions or applicable laws, the content may no longer be reflective of current opinions or positions.

The FSA Safety Net® is designed to represent an exit point for each security within a portfolio and to help reduce losses from sustained drops in the financial markets. The FSA Safety Net® is not effective and will not protect assets in abrupt/sudden market drops. Examples of such occurrences include, but are not limited to, the market crash of October 1987, the market drop in October 1989, the market disruption caused by the terrorist attacks of September 2001, and the flash crash of May 2010. Similar future occurrences could reduce the effectiveness of the FSA Safety Net®. In addition, the FSA Safety Net® will not protect assets in the event mutual fund companies, custodial companies, or the securities exchanges themselves, at their discretion, suspend, disallow, or fail to conduct trades, redemptions, or liquidations.

Inverse/Enhanced investments: FSA may utilize inverse (short) mutual funds and/or exchange-traded investments/funds (ETFs) that are designed to perform in an inverse (opposite) relationship to certain market indices (at a rate of one or more times the inverse result of the corresponding index). In addition, FSA may also use leveraged (enhanced) mutual funds or ETFs that provide an enhanced relationship to certain market indices (at a rate of more than one times the actual result of the corresponding index). There can be no assurance that any such investment will prove profitable or successful. In light of these enhanced risks/rewards, clients may direct FSA, in writing, not to employ any or all such investments.

Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from FSA.

Financial Services Advisory is neither a law firm, accounting firm nor insurance agency and no portion of this newsletter should be construed as legal, tax, insurance or accounting advice. FSA advisors are not attorneys, accountants, insurance agents or comprehensive financial planners and no portion of its services should be construed as legal, accounting, insurance, or tax advice.

For further details, including FSA’s current Disclosure Brochure discussing our advisory services and fees, please see important disclosures at www.FSAinvest.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement.

Please remember that it remains your responsibility to advise FSA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.