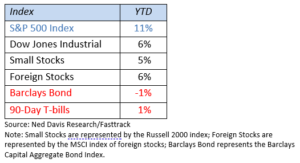

Stocks continued their march higher in the first quarter of 2024. Building on the rally that began in November, U.S. stocks posted gains in January, February, and March. As you can see from the table below, the S&P 500 Index remains the favored asset class, an amazing run over ten years of dominating the performance derby. Nevertheless, it was a solid quarter for most equity areas of the market, with small-cap stocks and foreign stocks posting above-average returns for the quarter.

While areas of the market like technology posted the strongest returns, ten of the eleven sectors that make up the S&P 500 Index managed gains. Only real estate posted a modest loss.

Things were not so rosy for the fixed income world. The broad bond index that tracks high-quality bonds was down slightly for the quarter, and even the high-yield bond index managed only a slight rise. High-yield bonds are a favorite of FSA because they typically go up when the equity markets rise but are less volatile than stocks.

Since the FSA strategies were close to fully invested at the start of the year, they all participated nicely in the first quarter rally. Obviously, the more aggressive strategies fared the best, but even the strategies that hold a sizable fixed income allocation made solid gains.

Overall, trading was light for the quarter as we continued to move the portfolios into large-cap domestic funds. With the S&P 500 Index leading the way, we have been content to own S&P-like funds. On the fixed income side, we have favored high-yield funds over high-quality funds given that interest rates have continued to drift higher. With most stock indices sitting at new all-time highs, the FSA strategies are likewise at all-time highs.

Where to from Here?

What can we expect after a rise in stocks of 10% in one quarter? Are they likely to keep climbing, or will the market reverse itself? A study by Ned Davis Research argues that we should expect stocks to continue their ascent. Going back to 1926, their analysts looked at the times when the S&P 500 Index climbed 10% or more in a quarter (keep in mind that stocks tend to average 10% in an entire year, so this is quite a pop.). There were 14 times of such an occurrence, the first time in 1930 and the last time in 2019. The average gain after a 10% gain in the first quarter was another 7% gain in quarters two through four—not as exciting as the first quarter—but a solid gain, nonetheless. So, historically speaking, a strong gain early in the year should not deter investors from staying the course.

From a technical perspective, the environment looks healthy as well. Most equity and even bond indices are in uptrends. And while it was mostly technology stocks participating last year and early this year, we have seen a broadening out of the rally in February and March. A healthy market is one in which large, medium, and small companies all participate.

To be sure, after a rally such as we have just seen, with stocks rising over 20% since November, it would seem reasonable, and even healthy, for stocks to fall back or at least stall out for some time. In addition, we will soon be entering the historically weaker season for stocks, from May through October.

Of course, the elephant in the room is the upcoming election, pitting a sitting president against a former president. The stock market has not seen this situation in over 100 years. No doubt that as the campaigns shift from the primaries to the general election, stocks may get buffeted in the back and forth of campaign statements and who appears to be forging ahead in the polls.

Whatever occurs on the political and the economic fronts, the investment team will be monitoring the FSA Safety Nets®, with the goal of protecting the gains from last year and this year. As we have said many times, it is not what you make but what you keep that counts.

Portfolio Update

Keep in mind that because we manage clients’ portfolios individually, the holdings in your specific accounts may differ somewhat from the averages.

Strategies That Employ the FSA Safety Net®

Income (Strategy 1)

The first quarter of 2024 saw bonds of all types continue to struggle in the face of relatively stubborn high interest rates. During the quarter we added a fund that owns so-called catastrophe bonds which pay out interest on bonds that insure against hurricanes, earthquakes, or other natural disasters. Currently, the portfolios in this strategy hold roughly 20% in high-yield bond funds, 20% in intermediate-term high-quality bond funds, with over 55% in more eclectic bond funds that have weathered this difficult bond environment.

Income & Growth (Strategy 2)

Since we entered the year essentially fully invested, with the stock allocation at its maximum allowance of 50%, trading in this strategy was light during the quarter. The stock component includes two large-cap pure equity funds, as well as two more defensive large-cap funds. The bond component consists of 10% high-yield bond funds, 10% high-quality bond funds, and over 25% in more eclectic funds that fare relatively well in an environment of rising interest rates.

Conservative Growth (Strategy 3)

Conservative Growth accounts also were near their maximum equity allocations at the start of the year, so these accounts participated nicely with the market’s first quarter rally. The equity component is exclusively in large-cap funds and domestic-only. The bond position is solely in high-yield bonds. At quarter’s end, these accounts held over 75% in equity funds and 20% in high-yield bond funds, with a minimal 2% in money markets.

Core Equity (Strategy 4)

Core Equity accounts posted strong results for the quarter since they were fully invested all year. During the quarter, we exited the modest small-cap position and reduced the tilt towards value. Currently, the portfolios hold large-cap domestic funds exclusively, with a mild tilt towards growth stocks.

Tactical Growth (Strategy 5)

There were strong returns for the quarter from this eclectic and aggressive strategy. Trading has been relatively light this year, but we did sell the uranium fund and the biotechnology fund, while adding a communications fund (with holdings of Google and Facebook) and an industrials fund (includes Caterpillar and GE). We also added a small allocation to a bitcoin fund. In some accounts we also added a fund that invests in Japanese stocks. The money market allocation is no more than 2%.

Active Strategies WITHOUT the FSA Safety Net®

Sector Rotation

The rotation strategy fares better during a broader market when there are more areas of the market participating in the rally. As a result, Sector Rotation had a more muted return in the first quarter. The rotation among the sectors has been active which makes the selection process more challenging. For the April rotation this strategy holds technology, semiconductors, financial services, industrials, retail, and health care.

Global Rotation

There were no trades in the first quarter for this aggressive rotation strategy. Growth stock funds dominate the portfolio currently, which means there is a heavy weighting in technology stocks.

Strategies That Remain Fully Invested Through ALL Market Cycles

Global Moderate

This moderate portfolio, which holds 70% in equities and 30% in fixed income at all times, posted a solid return for the quarter, even though the returns were hampered by the lagging results from real estate and emerging markets. On the positive side, gold provided a nice lift.

Global Growth

This aggressive portfolio, which always holds 90% in equities and 10% in fixed income, posted a solid return for the quarter, even though the returns were hampered by the lagging results from real estate and emerging markets. On the positive side, gold provided a nice lift.

Please remember to inform your advisor of any changes in your life that might affect your investment objectives and how we manage your money.

Ronald Rough, CFA

Chief Investment Officer

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.