Last month, my colleague Mary Ann Drucker wrote an FSA Market Update on how the coronavirus has affected the stock market compared with previous health scares such as SARS and the Ebola virus (a link to that Market Update can be found here: https://fsainvest.com/february-2020-investment-update/). Given the coronavirus’s persistence as a potential macro headwind, I would like to take this opportunity to check in on the health of the global economy as we head further into 2020.

In the past couple of weeks, we have seen a tremendous amount of volatility in the markets, downside and upside. In the final week of February, the S&P 500 had its worst one week of performance since the 2008 financial crisis, followed by a week of wild swings, both up and down.

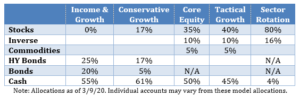

As we wrote in our two recent Interim Market Updates, we have gone from a heavy stock allocation to a position that is quite defensive. The table below shows the broad asset allocations of our five strategies as of March 9:

While the mortality rate from the coronavirus is below that of previous epidemics at this time, the containment effort itself may lead to the global economy slamming on the brakes until the virus ceases to be an issue. The recent market volatility can be attributed in large part to fear that the virus will slow global growth. Combined with already tepid growth in some regions, the actions taken to prevent the spread of the virus may tip some economies into recession this year. I will examine a few important regions below:

Asia

The outbreak of the coronavirus in mainland China coincided with the Lunar New Year, the biggest annual holiday on the Chinese calendar. In a normal year, manufacturing and general business activity would have slowed in late January anyway, but given the health fear this year, first-quarter economic numbers have been softer than expected as the government has been reluctant to allow citizens to return to factory work. China has already seen a contraction in February manufacturing activity as measured by the Purchasing Managers’ Index (PMI). The PMI last month was 35.7 (a reading below 50 signifies a contraction). The PMI will have to rebound quickly for global growth to occur.

In other Asian countries, there were already signs of economic slowing before the coronavirus became newsworthy. That’s particularly true in Japan where fourth-quarter GDP contracted by 6.3% on an annualized basis. As populations in the Asia-Pacific region remain concerned about contracting the potentially fatal virus, businesses that cater to large crowds (movie theaters, restaurants, theme parks, etc.) may all suffer significant hits to their bottom lines in the first quarter and beyond. A clear example of this is in Macau where casino revenue plunged 88% over the last year, according to The Motley Fool.

Europe

The European economy has experienced slow growth for several consecutive years, with 2019 being no exception. Annual growth for the region came in at just 1.2%, with Germany, often seen as Europe’s economic powerhouse, clocking in at half that (0.6%). In 2019, GDP grew by 0.8% in France and not at all in Italy. With cases of the coronavirus spiking in popular tourist destinations such as Milan, questions arise. Will the virus still be prevalent heading into the busy summer vacation season? Will it continue to spread to other popular vacation destinations? And if so, how badly is it likely to dent tourist spending?

North America

At home, our own markets may not be out of the woods yet. Given supply-chain disruptions in China and a continuing cancellation of travel spending, first-quarter U.S. earnings and GDP numbers could prove to be worse than analysts’ estimates.

At FSA, we remain vigilant of macroeconomic events that could affect the markets. Unless stocks can mount a recovery this week, most clients will find themselves holding no equity positions since all equity funds have broken through their FSA Safety Nets® as of March 9.

As always, if you have any questions or comments, please don’t hesitate to call or send us an email at questions@fsainvest.com.

Derek Kravitz

Investment Analyst

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.