After stocks posted the worst December decline since 1931, they promptly rebounded in January and posted the best January return since 1987. And the returns were broad based, with smaller company stocks, foreign stocks, and even commodities participating. All eleven sectors within the S&P 500 index were up in January, which is unusual. High yield bonds also had a nice bounce, as they tend to move with the equity market. Even conventional bonds, that are more sensitive to changing interest rates, had a positive start to the year. All in all, a pretty strong month for most asset classes.

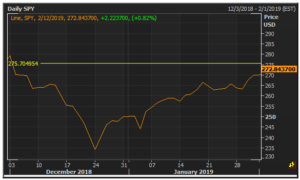

However, if you look at the chart below, you will see that what looked like a nice rally in January was really just stocks recovering (most of) the drop in December. The orange line is the S&P 500 index for December and January (the horizontal line marks the level of the S&P 500 index on November 30). Investors who were fully invested in stocks at the end of last year lost 9% of their money in December and then recouped 8% of it in January.

The FSA approach is to move assets away from sharply falling areas of the market to avoid the emotional and financial pain of those losses. Because of this, FSA accounts avoided most of the extreme drop in December and subsequently did not participate much in the January rebound. Nevertheless, over that two-month interval, FSA accounts were in line with (if not better than) the broad stock market—without the rollercoaster experience.

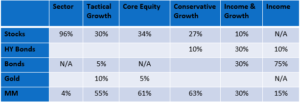

Of course, as the year moves forward, the obvious question becomes, “When do we start moving back into stocks?” From our vantage point, we believe it is already time to do so. In fact, since mid-January we have been gradually shifting the portfolios back into stocks and high yield bonds. The table below shows how each of the six strategies is invested as of February 1:

After sharp sell-offs like the one we witnessed last quarter, which took stocks down nearly 15%, it is common to see stocks bounce off the bottom and then retest those low points some weeks or months later. As a result, we do not have the portfolios fully invested at this time; nevertheless, the higher that stocks move, the lower the odds are that stocks will retest their lows. Like all things in investing, it is a matter of weighing the probabilities of one outcome versus another. As long as stocks remain below their long-term trend lines and solidly within the year-long trading range, it is prudent to proceed with caution until stocks can re-establish an uptrend. While we are encouraged by the progress so far, this is not the time to throw caution to the wind.

Please let us know if you have any friends or family members who might be interested in our risk-managed approach to investing their retirement nest eggs. We would welcome the opportunity to work with them.

Ronald Rough, CFA

Director of Portfolio Management

Disclosures: Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. It should not be assumed that future performance of any specific investment, investment strategy or product (including the investments and/or investment strategies recommended and/or undertaken by FSA or the FSA Safety Net®), or any non-investment related services, content or advice, will prove successful or profitable, or equal any historical performance level(s).

The FSA Safety Net® is designed to represent an exit point for securities within a portfolio to help reduce losses during sustained downward trends. The FSA Safety Net® is not effective and will not protect assets in periods leading up to and including abrupt/sudden market downtrends. Examples of such occurrences include, but are not limited to, the market crash of October 1987, the market drop in October 1989, the market disruption caused by the terrorist attacks of September 2001 and the flash crash of May 2010. Similar future occurrences could reduce the effectiveness of the FSA Safety Net®. In addition, the FSA Safety Net® will not protect assets in the event that the account custodian, mutual fund sponsor or manager, annuity sponsor or manager, a specific security itself and/or the stock exchanges, at their discretion, suspends, disallows, or fails to conduct trades, exchanges, redemptions or liquidations requested by FSA or you.

Inverse/Enhanced investments: FSA may utilize inverse (short) mutual funds and/or exchange-traded investments/funds (ETFs) that are designed to perform in an inverse (opposite) relationship to certain market indices (at a rate of one or more times the inverse result of the corresponding index). In addition, FSA may also use leveraged (enhanced) mutual funds or ETFs that provide an enhanced relationship to certain market indices (at a rate of more than one times the actual result of the corresponding index). You may direct FSA, in writing, not to employ any or all such investments.

Due to various factors, including changing market conditions or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this communication serves as the receipt of, or as a substitute for, personalized investment advice from FSA.

FSA is not a law firm, accounting firm or an insurance agency, and no portion of FSA’s services should be construed as comprehensive financial planning or legal, insurance or accounting advice. Rather, you should seek the advice of your attorney, insurance agent, accountant or other corresponding professional advisor with respect to such issues.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is available at www.FSAinvest.com/disclosures or by calling 301-949-7300.

Please remember it is your exclusive obligation and sole responsibility to immediately notify FSA, in writing, if there is a change in your financial situation or investment objective(s) including, but not limited to, personal/financial situation, goals, needs or concerns/views regarding economic/political/financial climate as well as any changes in investment alternatives, restrictions, etc. for the purpose of reviewing, evaluating or revising any of FSA’s previous recommendations and/or services.