Stocks continued to forge higher in February, frustrating many investors who expected stocks to follow their historical tendency and retest the low levels hit in late December. Instead, stocks of all sizes and shapes have marched consistently higher in 2019.

In the chart below, which plots the prices of the S&P 500 index over the past year, you can see that stocks clearly remain in a year-long trading range framed by the highs hit in January 2018 and the lows hit in February of that year. (The horizontal lines show support and resistance levels as the S&P has risen and fallen.) Trading ranges are periods of transition for stocks, which means we can’t determine whether they will ultimately move higher (into a new uptrend, resuming the pattern from 2009) or lower (into a new downtrend or bear market). We need patience while the market absorbs the various economic and market data.

A number of cross-currents help explain why stocks have remained in this trading range, neither rising very much nor selling off very much.

- Federal Reserve actions

- Signs of a global economic slowdown

- A China-U.S. trade war

Investors were relieved when the Federal Reserve indicated that it had no plans to further increase interest rates and would do so only in the face of a strengthening economy. This was seen as good news by the markets. Somewhat ironically, economic data has been weakening a bit. In 2018, GDP (the measure of overall economic growth) slipped from 3.4% in the third quarter to 2.6% in the fourth quarter. Estimates for first-quarter GDP this year are coming in below 2%. This is a worrisome trend for investors to watch closely.

And of course, the final issue hanging over the markets is the trade war between the U.S. and China. While both sides claim that progress is being made and the tone suggests a deal will be reached, markets will remain on edge until something more certain is announced.

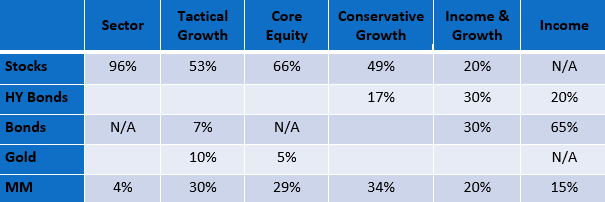

In line with our standard procedures, we have been prudently reinvesting the FSA portfolios as stocks have recovered their losses. In the table below, you can see how the six strategies are invested as of the end of February. In general, in the equity-oriented strategies, we brought down the money market allocation from roughly 60% to 30% in February. Given the current levels of stocks, we expect that progress in the weeks and months ahead could be choppy as stocks attempt to break to new highs. But if stocks continue climbing towards and above their previous highs, we will restore the portfolios to their fully invested positions.

Ron Rough, CFA

Director of Portfolio Management

Disclosures: Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. It should not be assumed that future performance of any specific investment, investment strategy or product (including the investments and/or investment strategies recommended and/or undertaken by FSA or the FSA Safety Net®), or any non-investment related services, content or advice, will prove successful or profitable, or equal any historical performance level(s).

The FSA Safety Net® is designed to represent an exit point for securities within a portfolio to help reduce losses during sustained downward trends. The FSA Safety Net® is not effective and will not protect assets in periods leading up to and including abrupt/sudden market downtrends. Examples of such occurrences include, but are not limited to, the market crash of October 1987, the market drop in October 1989, the market disruption caused by the terrorist attacks of September 2001 and the flash crash of May 2010. Similar future occurrences could reduce the effectiveness of the FSA Safety Net®. In addition, the FSA Safety Net® will not protect assets in the event that the account custodian, mutual fund sponsor or manager, annuity sponsor or manager, a specific security itself and/or the stock exchanges, at their discretion, suspends, disallows, or fails to conduct trades, exchanges, redemptions or liquidations requested by FSA or you.

Inverse/Enhanced investments: FSA may utilize inverse (short) mutual funds and/or exchange-traded investments/funds (ETFs) that are designed to perform in an inverse (opposite) relationship to certain market indices (at a rate of one or more times the inverse result of the corresponding index). In addition, FSA may also use leveraged (enhanced) mutual funds or ETFs that provide an enhanced relationship to certain market indices (at a rate of more than one times the actual result of the corresponding index). You may direct FSA, in writing, not to employ any or all such investments.

Due to various factors, including changing market conditions or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this communication serves as the receipt of, or as a substitute for, personalized investment advice from FSA.

FSA is not a law firm, accounting firm or an insurance agency, and no portion of FSA’s services should be construed as comprehensive financial planning or legal, insurance or accounting advice. Rather, you should seek the advice of your attorney, insurance agent, accountant or other corresponding professional advisor with respect to such issues.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is available at www.FSAinvest.com/disclosures or by calling 301-949-7300.

Please remember it is your exclusive obligation and sole responsibility to immediately notify FSA, in writing, if there is a change in your financial situation or investment objective(s) including, but not limited to, personal/financial situation, goals, needs or concerns/views regarding economic/political/financial climate as well as any changes in investment alternatives, restrictions, etc. for the purpose of reviewing, evaluating or revising any of FSA’s previous recommendations and/or services.