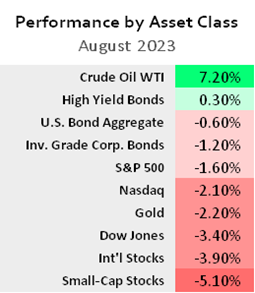

Markets spent the first half of August dipping to June price levels before a rigorous rebound at month’s end. A general uptrend in stock prices remains intact. The energy sector continued its summer rally on the heels of higher oil prices and new OPEC production cuts. The 10-year Treasury rate recorded a new cyclical high above 4.3%, putting more strain on credit conditions. Traders are bracing for the possibility of more rate hikes from the Federal Reserve later this year.

Despite the aggressive rate hikes, the U.S. economy is plugging away thanks to robust consumer spending, steady employment data, and vast government outlays. Inflation risk remains a hot topic; however, a resilient downtrend has materialized since mid-2022. The Atlanta Fed has issued an unofficial third quarter GDP growth forecast of 5.6%.

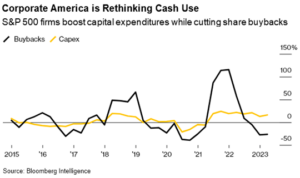

America’s largest corporations are making significant changes to their spending habits by investing in real growth (versus methods of financial engineering). It could even prove enough to argue against the “impending” recession that pundits love to predict. The near 0% borrowing rates from the post-2008 crisis created an era of share buybacks. The cost-benefit analysis was rather simple; managers could use excess cash (or borrow it) to satisfy shareholders without the risk of, say, building a new plant that might provide a similar return. Research from Bank of America has revealed an uptick in capital expenditures (i.e., expansion projects) and a decline in buyback activity. This shift could increase long-term productivity and strengthen earnings growth, potentially faster than the average investor expects.

An eagle eye’s view of the S&P 500 shows how far the index has recovered from the 2022 bear market. FSA portfolios were near fully invested at the beginning of summer as the evidence for participation merited greater conviction. Will stocks stay the course? Markets will likely continue to wrestle with the idea of higher rates as prices approach the “fully recovered” level. Volatility is inevitable which is the purpose our FSA Safety Net® serves – to trim exposure to downside risk when the markets turn down.

We hope you enjoy these last days of summer (cooler weather should be on the way in the DC area). Please remember to inform your advisor of any changes in your life that might affect your investment objectives and how we manage your money.

Jordan Daugherty, CFA

Investment Analyst

Disclosures are available at https://fsainvest.com/disclosures/market-update/.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is also available at https://fsainvest.com/disclosures/ or by calling 301-949-7300.